The Foundation of Catawba Valley Community College

The Catawba Valley Community College Foundation is a 501(c)3 nonprofit dedicated to supporting the vision and mission of Catawba Valley Community College (CVCC) in transforming our community while empowering our students.

Investing in the Future

Catawba Valley Community College is supported by the state, but enhanced by the Catawba Valley Community College Foundation, which enables the institution to strive toward its greater potential.

- More than 100 scholarships awarded annually

- More than 25 acres have been added to the CVCC Campus

- Endowments are available to help enrich students’ education experience

- Faculty members receive recognition and support for advanced course work

- Programs have been created, developed, and enhanced.

Contacts

Jennifer Jones, Chief Development Officer/ Executive Director of the Foundation

CVCC Foundation

828-327-7000 ext. 4288

2664 US Hwy 70 SE,

Hickory, NC 28602

Discover Red Hawk Nation.

CVCC Foundation Receives Duke Energy Grant to Support Planning for Proposed Sherrills Ford Distance Campus

|

3:00pm

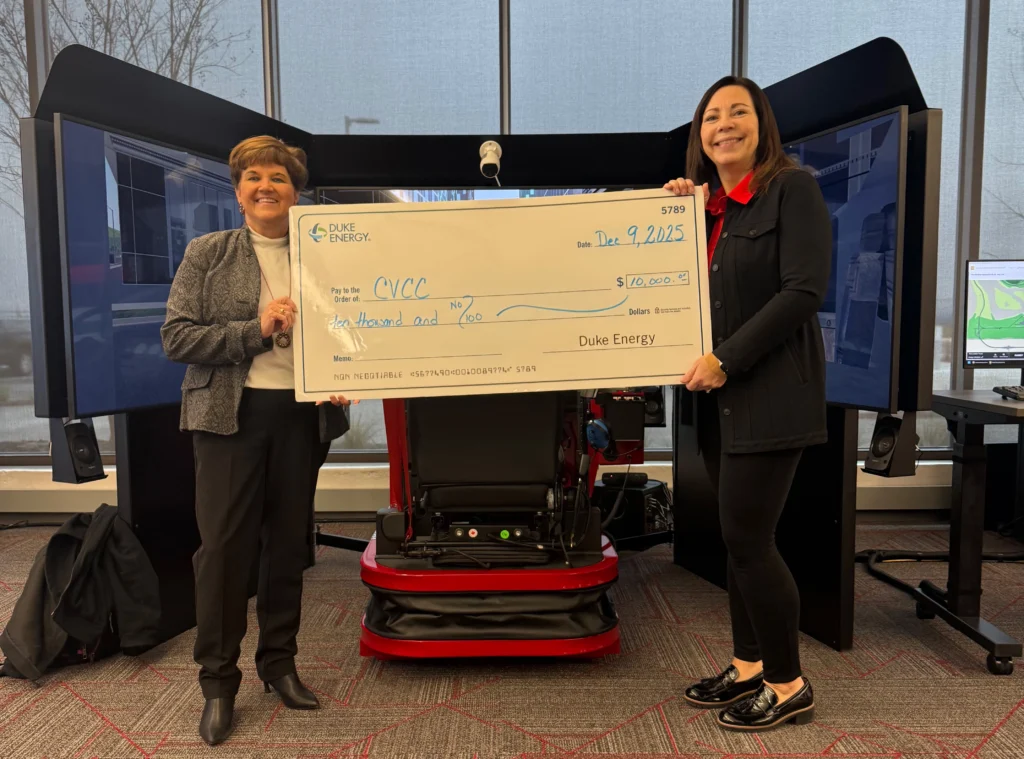

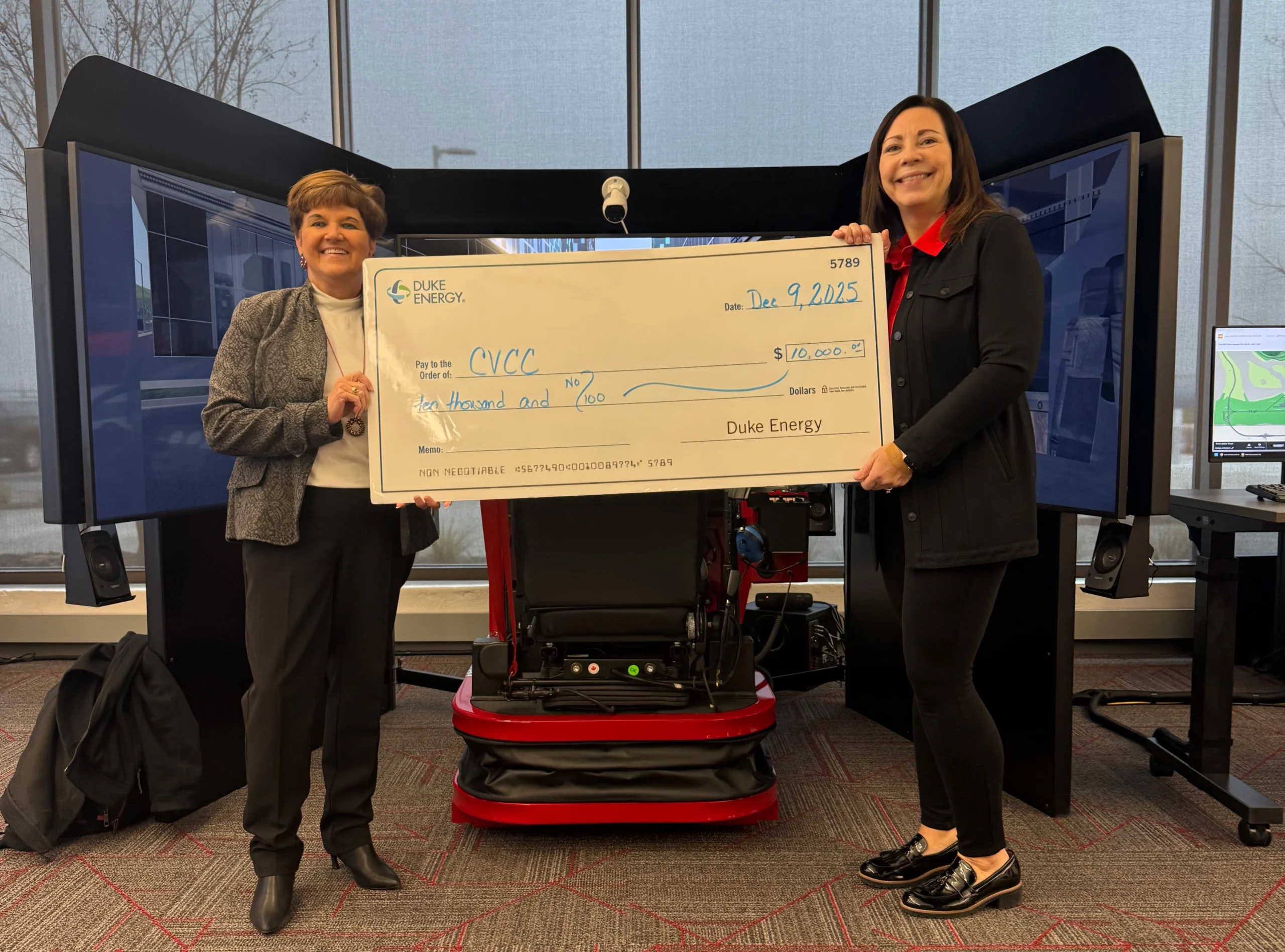

The Catawba Valley Community College (CVCC) Foundation is pleased to announce it has received a grant from Duke Energy to support CVCC’s exploration of expanding the college’s footprint in the Sherrills Ford community of Catawba County.

News

CVCC Foundation Receives Duke…

The Catawba Valley Community College (CVCC) Foundation is pleased to announce it has received a grant from Duke Energy to support CVCC’s exploration of expanding the college’s footprint in the Sherrills Ford community of Catawba County.

Catawba Valley Community Colle…

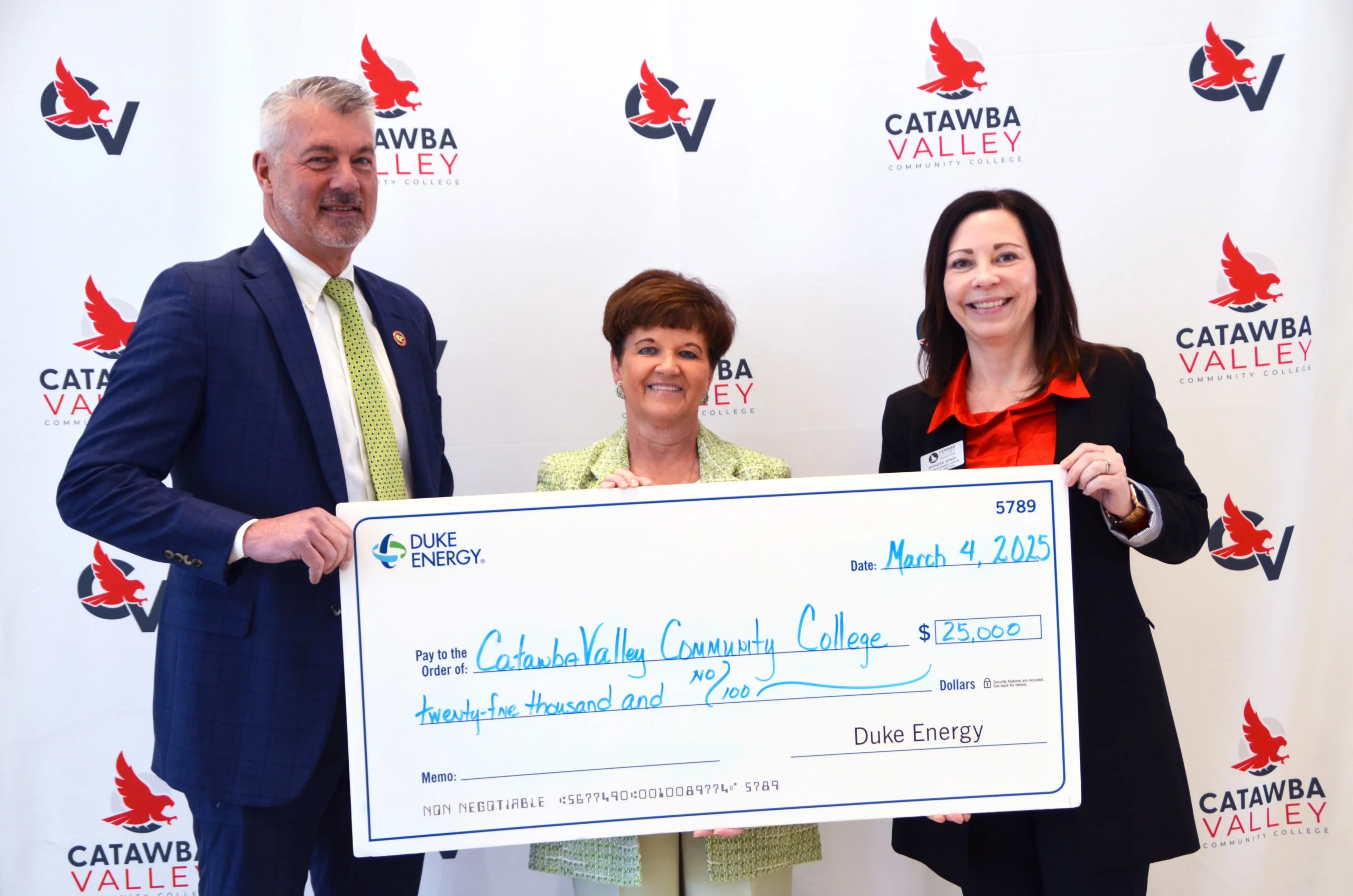

CVCC has been awarded a $25,000 workforce development grant from the Duke Energy Foundation to support its HVAC program.

CVCC Opens Valley Datacenter A…

Ribbon-cutting event for the new Valley Datacenter Academy.

CVCC Receives Gift from The Da…

Dale Earnhardt Foundation Gives to Regional Innovation Center